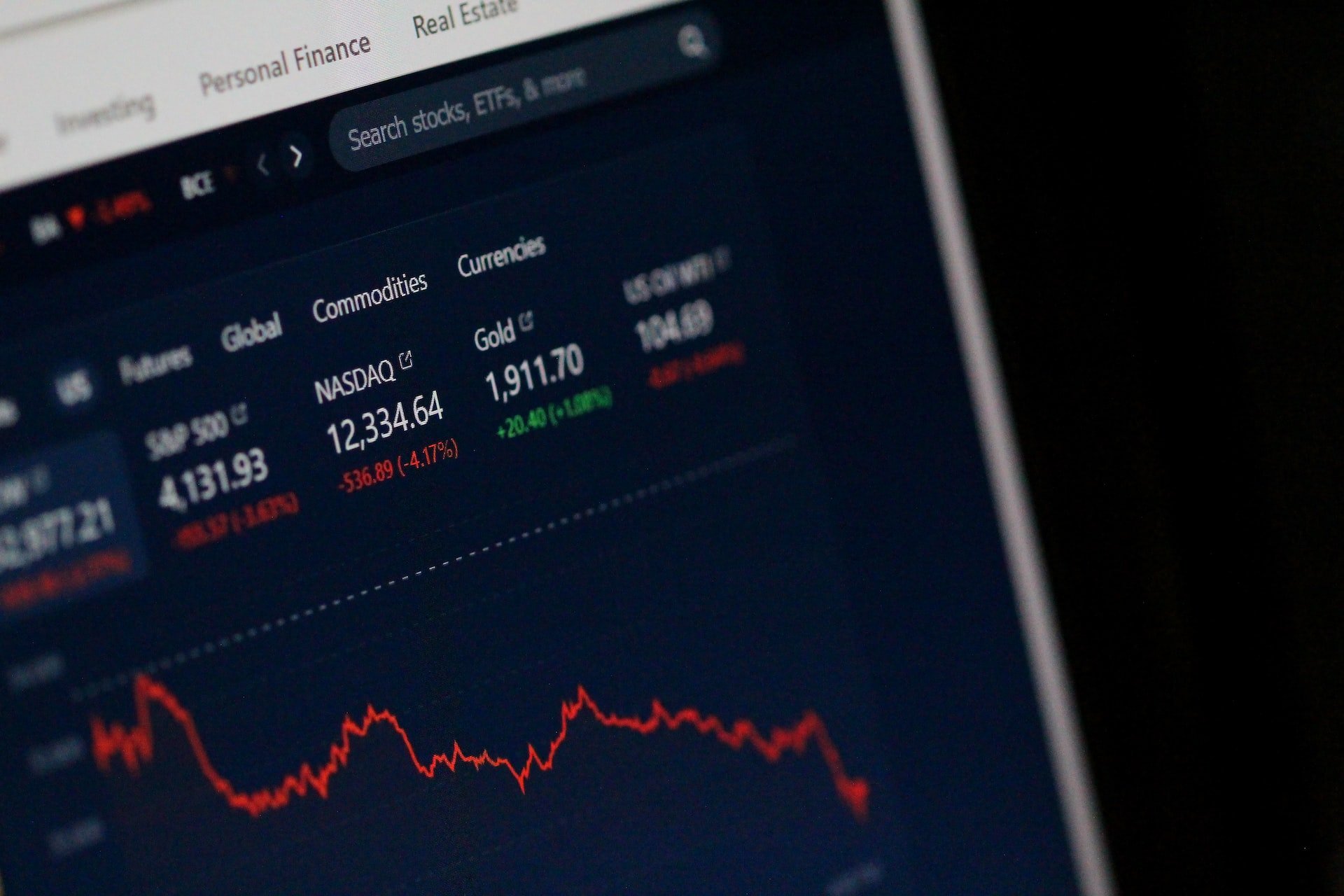

Managing your 401k accounts effectively is crucial to securing a stable financial future. Many people either overlook their 401k accounts or leave them unmanaged, especially those from previous employers. This can result in missed opportunities for growth and ...